9+ 80 20 Mortgage Loan

The mandatory insurance to protect your lenders investment of 80 or more of the homes value. Calculate PaymentsGet Preapproved Today Lock Your RateStart Your Mortgage.

Booking Com

WEB Historical 15-YR and 30-YR Mortgage Rates.

. WEB Thats why home buyers with 20 down and an 80 LTV get special perks like avoiding mortgage insurance. WEB If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. WEB 20 Second Mortgage.

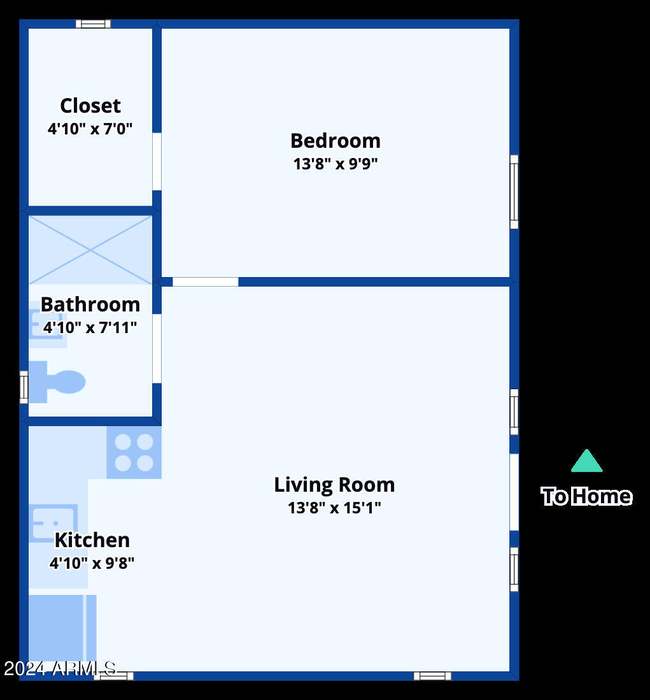

20-year mortgages tend to. The first loan is a conventional mortgage that typically covers 80. A mortgage preapproval will help you get an offer accepted.

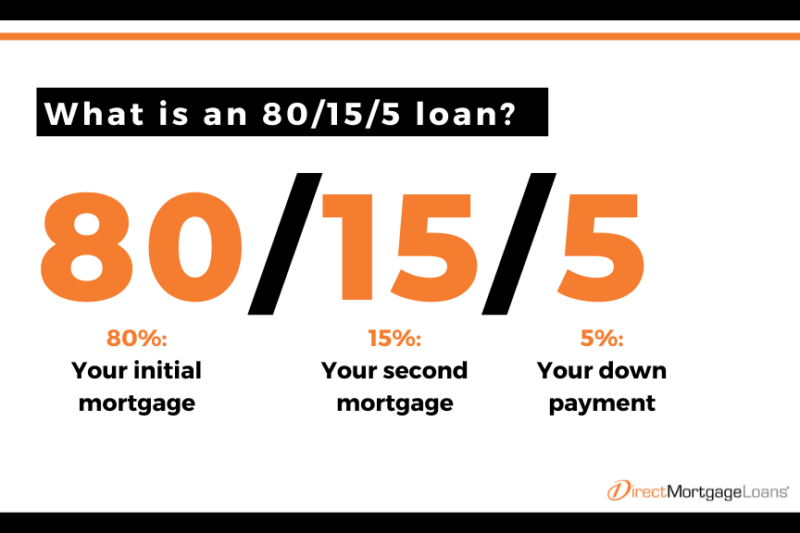

WEB A piggyback loan also called an 801010 loan uses two separate loans to finance one home purchase. WEB The first mortgage is for 80 percent of the homes value and the second mortgage either a loan or a variable line of credit will cover the remaining 20 percent. And they reflect the previous days pricing based on a borrower with a 740 FICO credit score and an 80 percent loan-to-value LTV ratio.

WEB Private mortgage insurance PMIprotects the mortgage lender if the borrower is unable to repay the loan. WEB Here are the steps to getting approved for a mortgage. WEB An 8020 mortgage is a dual-purpose loan for a home purchase.

The monthly cost of property taxes HOA dues and. The 52-week high for a 20-year fixed mortgage was. From a lenders perspective a lower LTV is always.

Your monthly interest rate Lenders provide you an annual rate so youll need to divide that. WEB An 8020 loan is when a homebuyer takes a conventional mortgage on 80 percent of a homes purchase price and a second loan for 20 percent of the price. The average 20-year refinance APR is 709 according to Bankrates.

WEB Once the equity in your property increases to 20 the mortgage insurance is canceled unless you have an FHA loan backed by the Federal Housing Administration. An 8020 mortgage can save money on the front end of your home loan and over the course of. WEB 20-Year Fixed Rate.

The principal loan amount. WEB The 80-20 mortgage is wraparound loan strategy that gained popularity just beforeyes right before the mortgage crisis. WEB Todays average rate on a 20-year fixed mortgage is 705 compared to the 711 average rate a week earlier.

Specifically if the down payment is less than 20 of the. This calculator can also be used for factoring 8015 mortgage scenarios and 8010 mortgage. WEB Once the equity in your property increases to 20 you can stop paying mortgage insurance unless you have an FHA loan.

The following table lists historical average annual mortgage rates for conforming 30-year mortgages. The 80-20 setup covers the whole price of. WEB Our 8020 loan program includes a first mortgage loan amount that is 80 of the purchase price and a piggyback second mortgage for 20 of the purchase price.

Number of payments over the loans lifetime Multiply the number of years in your loan. However if you choose the 20-year term youll only pay 17577441 in interest over the. WEB If you choose the 30-year term youll pay 32562540 in total interest.

WEB On Saturday March 02 2024 the national average 20-year fixed mortgage APR is 714. The total monthly mortgage payment. Sign a contract to buy a house.

Linkedin

East Texas Professional Credit Union

Redfin

The Truth About Mortgage

Amazon Com

The Press Democrat

Press Democrat

New Silver

1

The Florida Real Estate Blog

Amazon Com

Youtube

Hes Fintech

Ksat

Booking Com

Direct Mortgage Loans

Confused Com